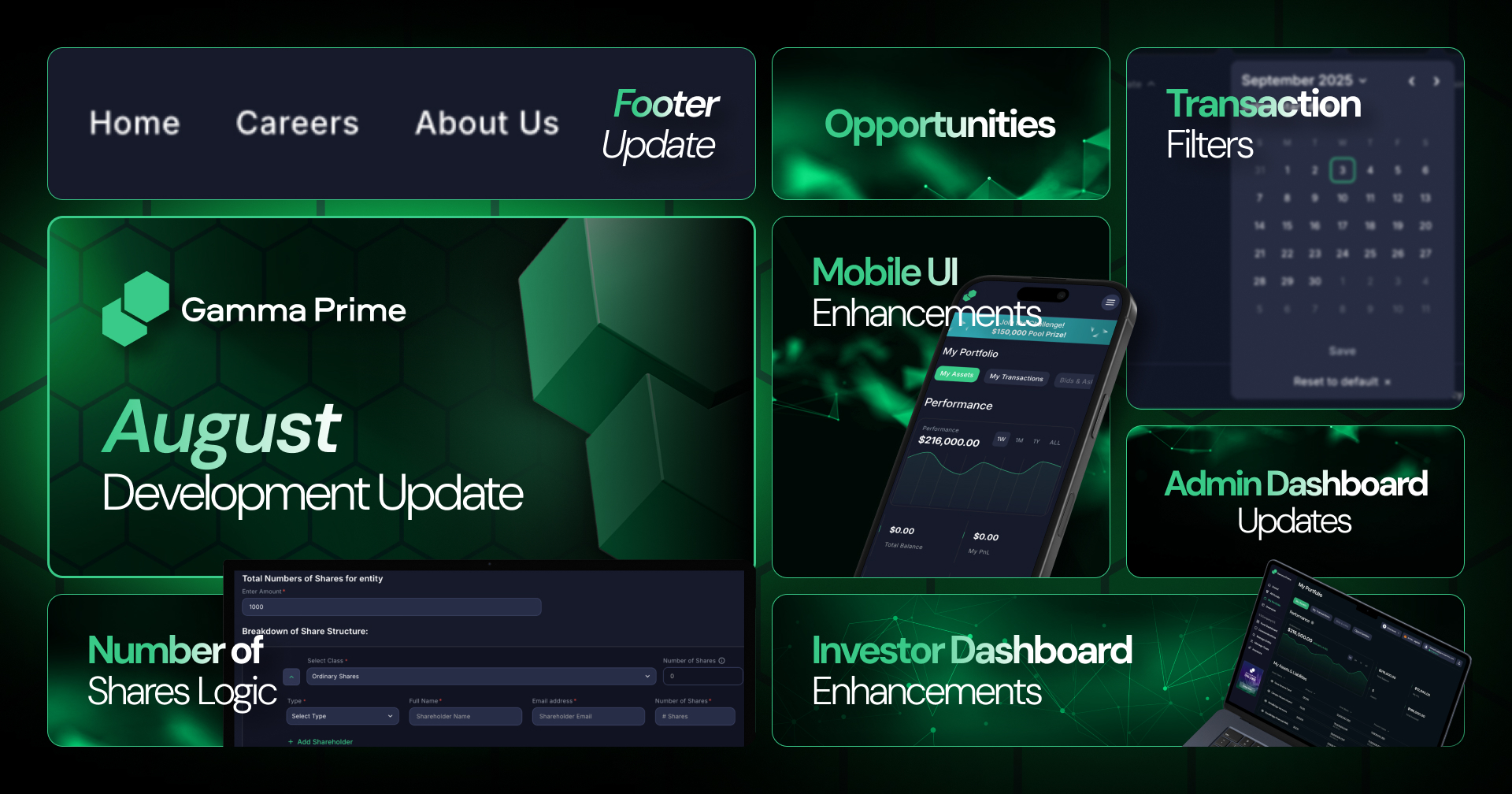

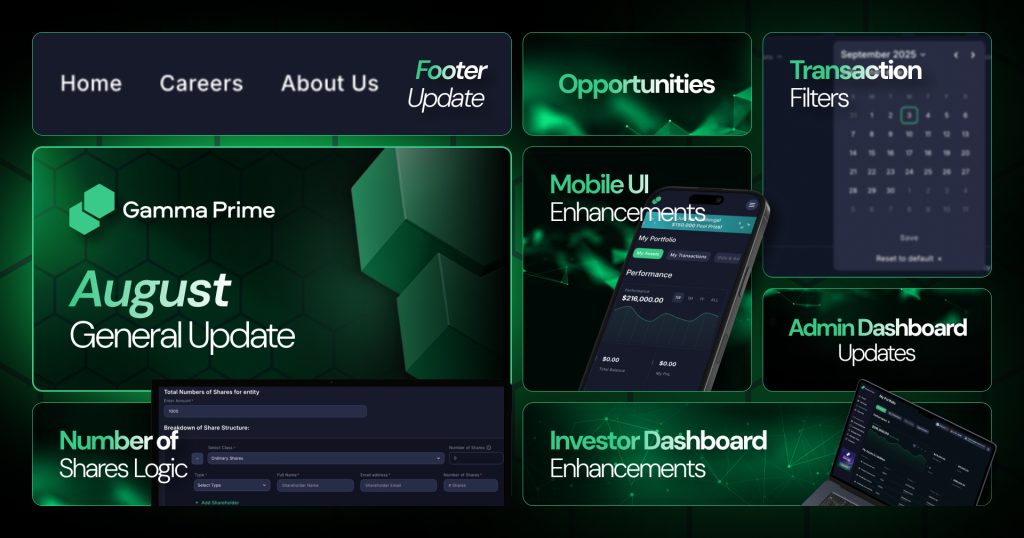

In August, we worked on updates across the dashboard, mobile interface and admin tools. The focus was on making the platform easier to use and more accurate. These updates improve daily workflows for both investors and admins.

Investor Dashboard Enhancements

The Investor Dashboard now shows assets and pending items in separate sections. Charts and metrics have been improved, allowing users to clearly see overall performance or focus on a single asset. Pending assets are shown with icons and tooltips, and they no longer count toward totals until confirmed. This avoids confusion between finalized and pending transactions.

The Transactions tab has been updated to remove blockchain details and use simple labels like Subscription, Capital Contribution, Dividend, and others. We also prepared the tab for future buy and sell order features. This ensures that users already have a clean structure while we build more advanced tools.

Opportunities

The Opportunities section now has four clear parts: Following, Recommendations, Recently Watched, and Top 10 list. This helps users see the funds they follow, get suggestions, and revisit recent interests. The mix of personal and curated lists gives investors both flexibility and reliable guidance. It also makes it easier to find new funds without searching manually.

Footer Update

The footer design has been updated to make navigation easier. It now gives quicker access to support, documentation, and compliance links. The new structure will also let us add more useful links in the future without changing the layout. This makes the footer more practical for everyday use.

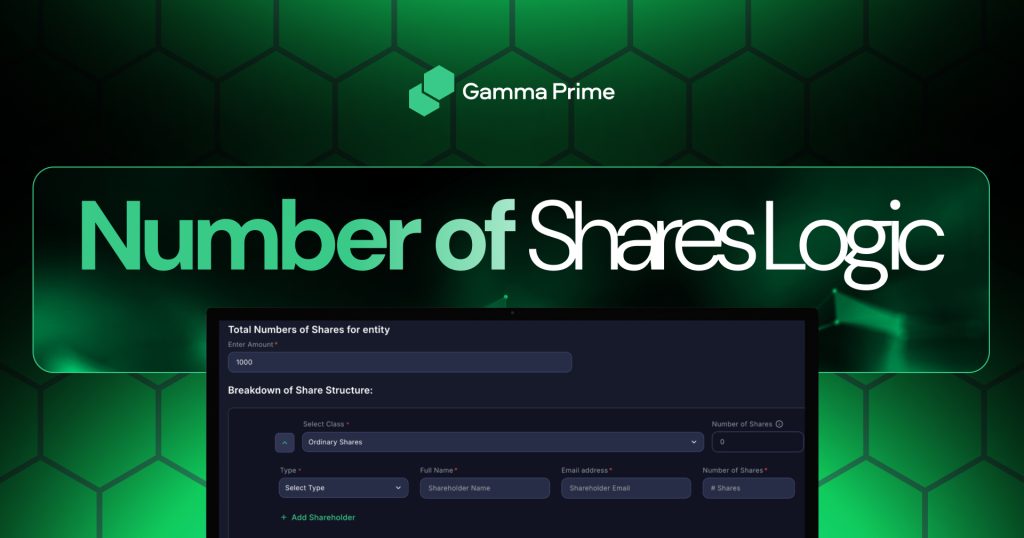

Number of Shares Logic

Institutional accounts now include a section for the Total Number of Shares and Aggregated Figures. Aggregated numbers and percentages are calculated automatically from each share class. If totals don’t match, users see a warning. If the total is exceeded, the system blocks submission. This ensures accurate calculations and prevents mistakes when setting up funds.

Mobile UI Enhancements

The My Portfolio tab on mobile was updated to make performance and asset data easier to read. The Create Entity flow on mobile was also improved with clearer input fields and simpler steps. These changes make it easier for investors to work on the platform from their phones. Mobile performance was also improved, so screens load faster.

Transaction Filters

Transactions in the My Portfolio tab can now be filtered by date. This makes it easier to track and review activity over time. Users can quickly search past activity without scrolling through long lists.

Admin Dashboard Updates

The Admin Dashboard now has updated columns and filters in the Entity Profile and Investor views. The user profile also includes an updated contact button for institutional accounts. We added placeholders for bar charts that will be used in upcoming releases. These changes make the dashboard cleaner and ready for more data visualization.

1,500+ Attendee Conference

Join us on September 30th in Singapore for a high-impact summit bringing together leaders in capital markets, institutional investors, fund managers, compliance experts, and innovators. It will be the largest institutional finance conference in Singapore, designed to address the most important trends shaping the future of finance.

The summit will highlight real-world applications of technologies that improve efficiency, liquidity, and market access worldwide. Attendees will hear insights from top speakers, including experts from MG Stover, KPMG, and multi-billion AUM funds. Senior decision-makers from hedge funds, private equity, family offices, and other institutional firms will share their insights in high-level discussions.

The Tokenized Capital Summit has already taken place in Denver, Dubai and Cannes this year, attracting more than 1,500 participants.

$3.5 Billion Assets Joined Gamma Prime

Gamma Prime continues to expand, with total fund assets onboarded reaching $3.5 billion. More institutional players and fund managers are choosing to operate through the platform, underscoring the trust Gamma Prime is building in the market.

$30 Million in Capital Introductions

Capital introduction has already overcome $30 million, demonstrating strong development in connecting funds with investors. At the same time, the LP network grew by 15% in August, further expanding the depth and diversity of participants on the platform.

First Funds Listed on Gamma Prime

First funds have officially joined and are now listed on the Gamma Prime, making them visible to a wide network of institutional investors. This marks an important step toward building a transparent and accessible marketplace for uncorrelated investment strategies.

Hosted 25+ Funds on X Spaces

In August, we hosted more than 25 funds on Twitter Spaces, featuring thought leaders such as Michael Terpin, C-Levels from Gate.io, Mantle, TDX. These sessions provided direct access to leading voices and further expanded the platform’s reach.

Closing Note

The August updates focused on small but important improvements across many parts of the platform. Each change helps investors, admins, and institutions work with more clarity and fewer errors. This prepares us for larger features that will be released in the coming months.